Etf expense ratio calculator

Ad Learn More About American Funds Objective-Based Approach to Investing. Ad Explore How PIMCO Has Been At The Forefront Of Active Fixed Income ETF Investing.

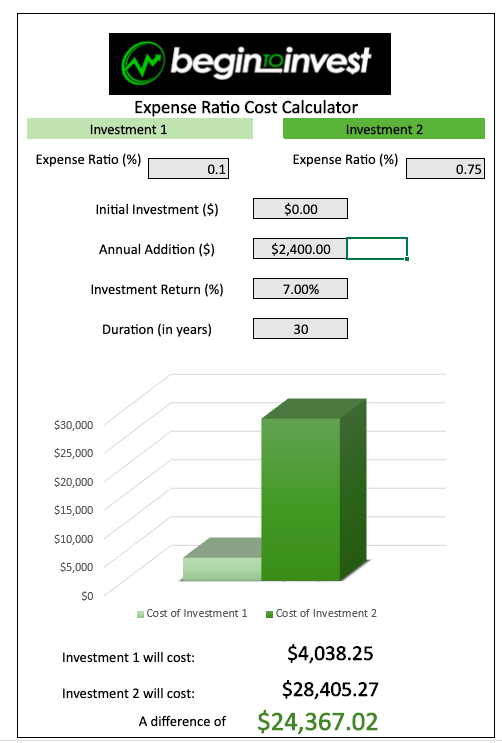

Expense Ratio Calculator For Etfs And Mutual Funds Begin To Invest

How the ETF expense ratio works.

. The expense ratio is a measure of what it costs an investment company to operate a mutual fund. Expense ratios are the fees you pay while owning a mutual fund or an ETF. Calculate the expense ratio of the fund if the asset under management for the fund stood at 1000 million as on December 31 2019.

Thanks to Julius Prezelski for finding this expense ratio calculator. Exchange-traded funds ETFs are similar to mutual funds except that they trade intraday like stocks. The trick is to produce a weighted average expense ratio that will reflect the expense ratio you are paying on the total of your fund holdings.

This charge covers the costs of management asset allocation marketing and other services. Some mutual funds are sold with a front-end or back-end load. The Mutual Fund Cost Calculator enables investors to easily estimate and compare the costs of owning mutual funds.

Management Fees is calculated using the. That means that for every 1000 you invest you pay less than 10 a year in expenses. Certificate of Deposit Calculator.

Explore How To Use ETFs with iShares Today. Ad Your Investment Goals Are Unique. Visit Us Online Today To View Our Full List Of ETF Offerings.

Let us understand the expense ratio meaning with an expense ratio example assuming your mutual fund schemes expense ratio is 125. The Operating Expense Ratio OER is calculated by dividing the annual fund operating expenses by the highest one-year total return of any portfolio he has ever published. An expense ratio is determined through an annual.

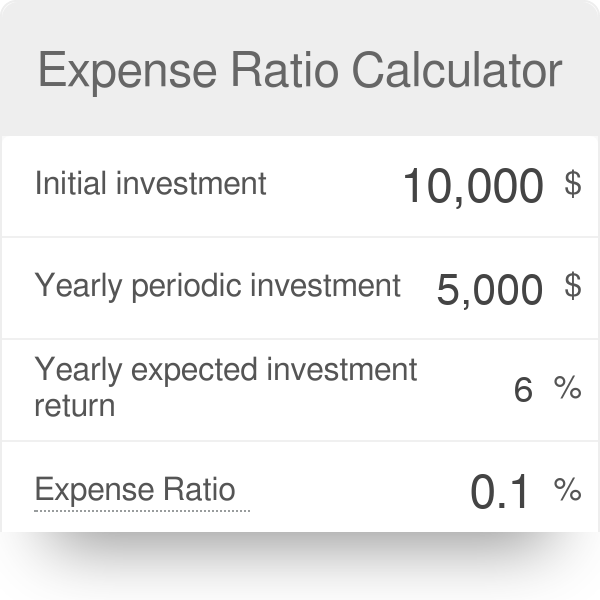

Aim Higher With PIMCO ETFs. Expense Ratio Calculator - calculate expense ratio which is a financial ratio that measures the annual fee that funds or ETFs charge their shareholders compare to the fund assets. If your investment in this fund is Rs 100000.

See How American Funds Can Help Improve Client Outcomes Through Objective-Based Investing. An expense ratio reflects how much a mutual fund or an ETF exchange-traded fund pays for portfolio management administration marketing and distribution among other expenses. Typical ETF expense ratios are less than 1.

The Cost Calculator takes the mystery and math. Unfortunately you dont get a bill at. Compound Interest Rate Calculator.

Use this tool to compare the potential costs of using ETFs or no-load mutual funds. Compound Annual Growth Rate Calculator. An expense ratio is a fee that a mutual fund or exchange-traded fund charges investors ETF.

The following cost per annum in are normally charged by mutual. Cash Flow to Debt Ratio Calculator. Even though ETFs can be relatively inexpensive investing in them does.

ETF Cost Calculator Calculate your personal investment fees Calculate how much you can save by investing with ETFs.

Paying More Than 0 4 Etf Fees Is Throwing Money Away

Actively Esg Etf Com Financial Advisors Segmentation Disease Prevention

Free Download Position Size Calculator Fo Rex Stocks And Commodity Trading Using Microsoft Excel Forex Trading Commodity Trading Trading Courses

Etf Fee Calculator

Etf Comparison Compare Any Etfs With Free Etf Comparison Tool

Analyze Portfolios Fundvisualizer Compare Mutual Funds Etfs And Portfolios

Expense Ratio Calculator For Etfs And Mutual Funds Begin To Invest

Are Fidelity S Zero Expense Ratio Funds For Real Fund Investing Stock Market Index

Vti Vanguard Total Stock Market Etf Vanguard Stock Market Vanguard Marketing

Low Cost Index Funds Choosefi

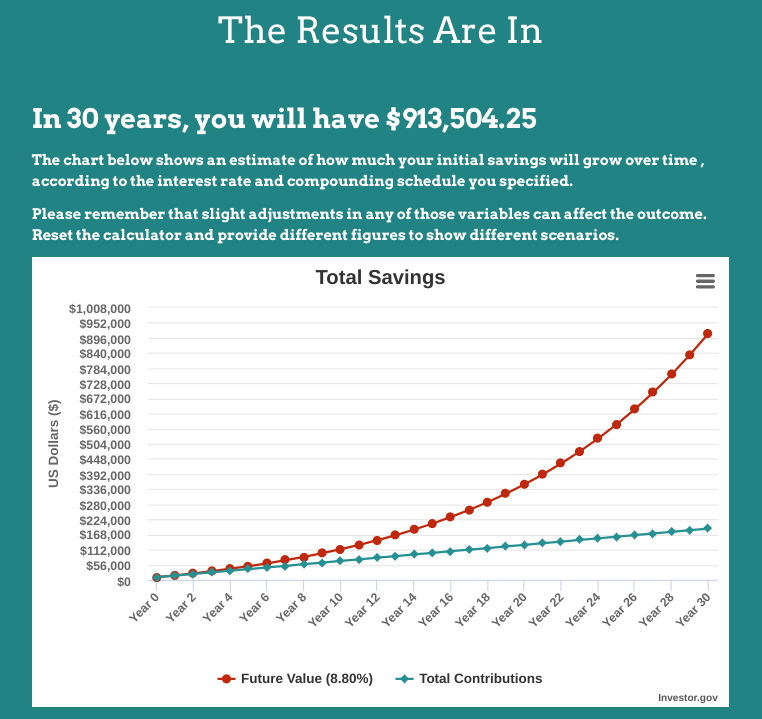

Interactive Expense Ratio Calculator For Mutual Funds And Etfs Blog

Expense Ratio Calculator For Etfs

Journal Entry Business Started With Cash How To Pass A Journal Entry Journal Entries Starting A Business Journal

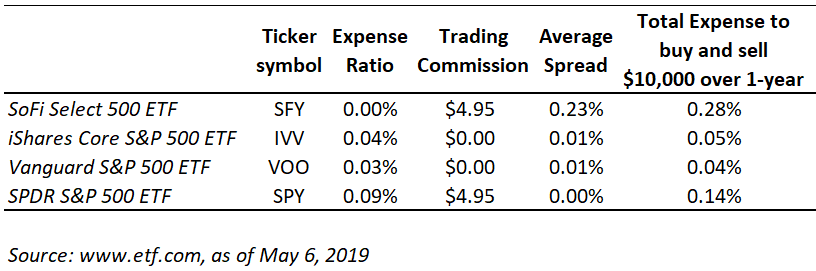

Zero Expense Ratio Etfs Have Arrived But May Carry Other Relevant Costs

How Etf Fees Work Calculate And Compare Index Fund Expense Ratios Tightfist Finance

How Simple Rules Can Beat The Market Morningstar Simple Rules Portfolio Management Inflection Point

What Etfs Really Cost Etf Com